Updated 14 July 2022

The Government has set out the range of issues caused by the Northern Ireland Protocol. These include trade disruption and diversion, significant costs and bureaucracy for traders and areas where people in Northern Ireland have not been able to benefit fully from the same advantages as those in the rest of the United Kingdom. This has contributed to a deep sense of concern that the links between Great Britain and Northern Ireland have been undermined. This document outlines the UK’s solution—fixing the problems so that Northern Ireland can move forward, while protecting the UK and EU markets so that no-one loses out.

The UK approach

Our preference is to negotiate solutions to the problems being faced by businesses, citizens and communities. Unfortunately, after eighteen months of talks we have not so far been able to agree on an outcome that provides a sustainable basis for operating the Protocol.

But we have made clear and comprehensive proposals which would deliver that sustainability, address the full range of issues raised by the Protocol and restore the balance of the Belfast (Good Friday) Agreement. This document outlines those proposals. In short they would:

- establish new “green channel” arrangements for goods staying in the UK – fixing the burdens and bureaucracy caused by the application of EU customs and SPS rules to all goods at present

- establish a new “dual regulatory” model to provide flexibility to choose between UK or EU rules – removing barriers to trade and managing risks of future divergence between UK and EU rules

- ensure the Government can set UK-wide policies on subsidy control and VAT – overcoming constraints that have meant NI has not benefited from the same support as other parts of the UK

- deal with the Protocol’s unequal governance, removing the role of the CJEU in dispute settlement and providing the means for UK authorities and courts to set out the arrangements which apply in Northern Ireland

We have also been clear that there are elements of the Protocol which are operating well and which should be preserved—such as on the Common Travel Area and North-South Cooperation.

Given the urgency and seriousness of the problems in Northern Ireland, we will be bringing forward legislation that will enable the sustainable operation of the Protocol in line with these proposals. In parallel we will seek proactively to achieve the same objectives through a negotiated settlement. Our legislation allows us to implement a negotiated agreement. In all scenarios we will remain committed to avoiding a hard border on the island of Ireland, and to respecting the EU’s legitimate interest to see its Single Market protected.

1. Trade: customs and agrifood

What is the problem

The UK has always accepted that special arrangements are necessary for the unique situation of Northern Ireland. But NI’s place in the UK internal market is being undermined due to the unnecessary checks and paperwork imposed by the Protocol.

The Protocol confirms Northern Ireland’s place in the UK’s customs territory and internal market.

But it imposes burdensome bureaucracy and paperwork, including full customs processes and onerous SPS import requirements, even for goods staying in the UK and not going to the EU.

- only a sixth of goods that move into Northern Ireland are determined to be at risk of entering the EU’s market – and yet the Protocol subjects them all to the full range of processes. This is disproportionate and unsustainable

- East-West trade links are critical to the economic success of Northern Ireland. The value of NI goods purchased from GB was more than four times that from Ireland – with GB an essential supplier to businesses and consumers in Northern Ireland

This has had impacts on costs for businesses and availability for consumers – with the prospect of further disruption for key sectors if existing grace periods are removed.

- goods relied on for generations, like seed potatoes and other native British plants and trees, can no longer reach NI growers

- business surveys note that over a hundred GB retailers have stopped serving customers in Northern Ireland, with warnings that sales volumes would fall by up to a third without grace periods

- these effects are felt through critical parts of the supply chain, from haulage firms and small businesses through to large retailers

Why we need to change the Protocol

The Protocol treats goods going from Great Britain to Northern Ireland as if they were going to another country.

Full international trade processes apply no matter where the goods are destined. Articles 5(3) and (4) of the Protocol apply full EU customs, and animal and plant health rules as goods move into Northern Ireland – with only very limited tariff easements for goods ‘not at risk’ of going into the EU under Article 5(2).

Businesses in Northern Ireland agree that this framework does not work for internal UK movements and needs to change. The EU has made proposals in October 2021 for an ‘express lane’ which were a response to the very significant challenges faced by businesses and consumers. But the conditions and limitations around these ‘non-paper’ proposals mean that they do not go far enough to make the Protocol sustainable for the future, still leaving:

- customs declarations for every journey irrespective of destination or risk – including finding a specific commodity code, from over 7000 items, for every item shipped

- a system of SPS import requirements with an official process needed for all items on a lorry, and a minimum requirement to physically check a significant proportion of all products, whatever their destination. This is regardless of the stringent traceability rules already in force in the UK which provide a high level of assurance

- complete bans on the movements of a range of plants, seeds and trees into Northern Ireland

- new and unnecessary process requirements on pets – with the prospect of around £250 in certificates and treatments for each movement, and

- declarations on millions of consumer parcels, disrupting day-to-day lives

These are only the most visible and burdensome requirements, there are many others which individually and collectively have a chilling effect on trade, and affect the viability of East-West trade.

UK solution

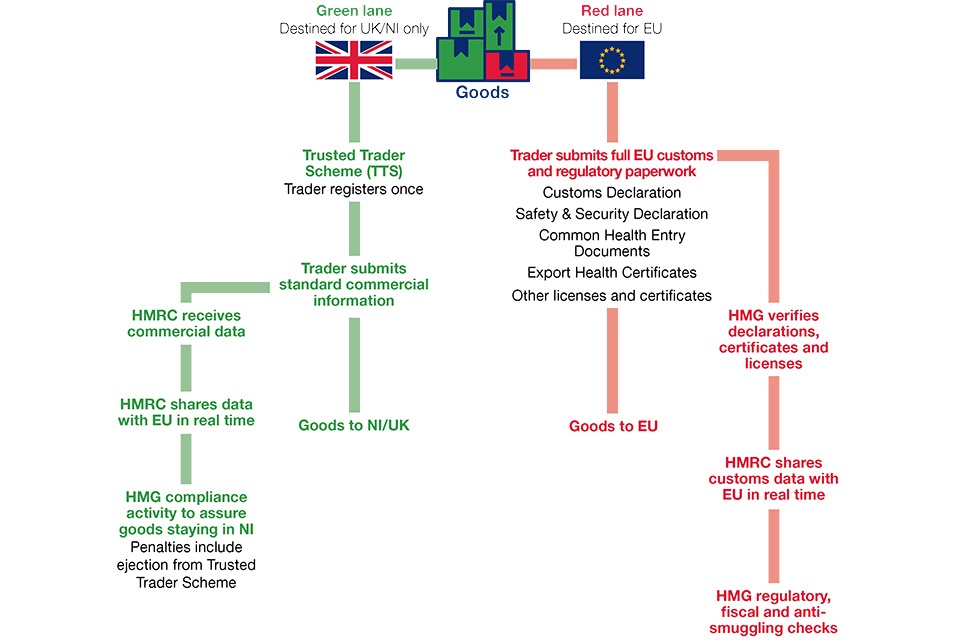

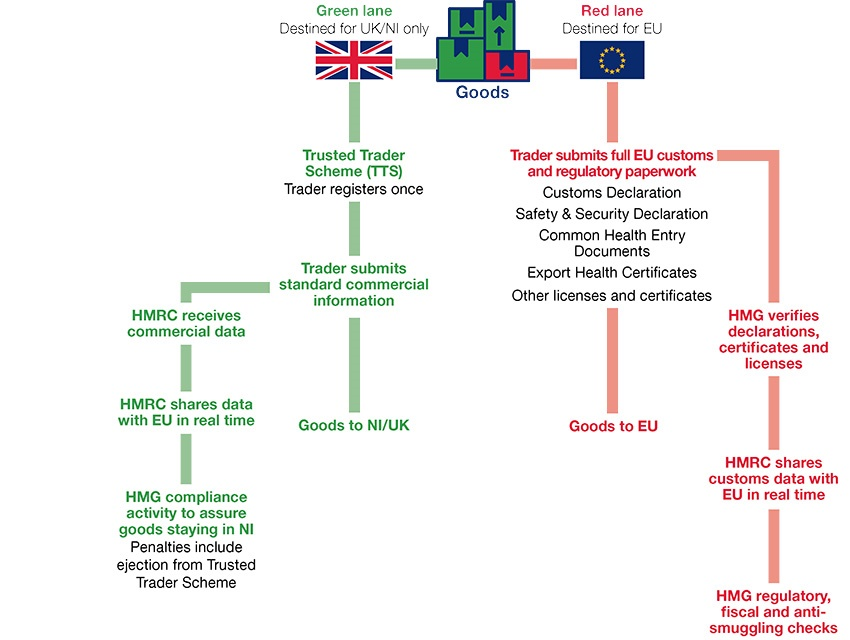

A new green and red lane approach backed by commercial data and a trusted trader scheme – removing burdens on internal UK trade while avoiding a border on the island of Ireland, protecting both markets and vastly reducing burdens for people and businesses.

Green lane for UK goods

Goods staying in the UK would be freed of unnecessary paperwork, checks and duties, with only ordinary commercial information required rather than customs processes or complex certification requirements for agrifood products.

This reduces checks on agri-food goods; removes tariffs on UK trade; and lifts unnecessary bans on goods.

Red lane for EU goods

Goods going to the EU, or moved by traders not in the new trusted trader scheme, would be subject to full checks and controls and full customs procedures—protecting the EU Single Market.

Trusted trader scheme overseen by UK authorities

The green lane would be reserved for those in a new, trusted trader scheme covering all goods movements. Traders will provide detailed information on their operations and supply chains to support robust audit and compliance work. Non-commercial goods, such as post and parcels, will automatically go through the green lane without the need for registration.

Strict and substantial penalties

Traders who abuse the new system will face robust penalties, including civil and criminal charges – and would not be able to use the green lane in the event of non-compliance.

Robust data-sharing

The UK is already providing more than a million rows of data per week with the EU. In the new model we would continue to share with the EU data assured by the UK government on the operation of the trusted trader scheme and on all goods moving between GB and NI – to monitor the risk of abuse and to allow for risk-led, intelligence sharing and co-operation.

- purpose-built IT: this would be delivered through a purpose-built IT system with information available in real time and well within the time taken to cross the Irish Sea

- green lane: sharing standard commercial data provided by traders

- red lane: sharing more than 110 fields of data collected through customs declarations as per the EU Customs Code

Rapid risk management

Where a different order of risk is posed, we will continue to apply controls – just as we did before the UK’s departure from the EU (as on live animals). UK and EU authorities would work together, under a new bespoke biosecurity assurance framework, to manage arrangements for goods that pose a different order of risk.

2. Regulations

What is the problem

The rules applied by the Protocol place barriers between Great Britain and Northern Ireland – barriers which will only increase as UK and EU rules change over time.

Regulated goods need to comply with EU rules to be placed on the market in Northern Ireland, even when they will never enter the EU single market.

These rules create significant burdens for businesses, especially those trading exclusively within the UK: they require firms to complete new paperwork and processes, or comply with specific product requirements – risking entire product lines being withdrawn or discontinued as EU regulations change.

- the EU is reviewing front of package (‘traffic light’) food labelling – risking the discontinuation of thousands of product lines and the withdrawal of popular and important products, which will not be replaced by supply chains in the Republic of Ireland or EU

- appointing new representatives in NI could cost businesses £330 to £1,400 per year; new tests could cost businesses from £500 to as much as £100,000 per product range; and new product markings could add £1,000 to £10,000 in costs

This serves to deter companies from supplying customers in Northern Ireland – risking limitations on access to critical goods which cannot be sourced from elsewhere.

- despite progress on human medicines, gaps remain and there are still critical risks for veterinary medicines from the end of the year – with potentially half of all veterinary medicines for a variety of animals and livestock facing discontinuation

With an estimated one-fifth of UK businesses selling manufactured goods in NI trading exclusively within the UK, particularly SMEs, NI traders will find it costly and increasingly difficult to receive goods from their existing GB suppliers.

Why we need change

The Protocol insists that most goods meet EU rules to be put on the Northern Ireland market – with no room for flexibility.

Goods made in Great Britain but sold exclusively in Northern Ireland are treated as ‘imports’ – and face burdensome paperwork and processes – even though they never leave the UK.

There is no mechanism to adapt or tailor goods rules for the Northern Ireland context – relying solely on unilateral EU changes, regardless of their impact on UK internal trade.

There is no durable framework for safeguarding Northern Ireland’s place in the UK market – despite the commitments in the Protocol to that effect, risks will only increase as rules change.

UK solution

A dual-regulatory regime that gives choice to NI business and can deal flexibly and durably with any barriers within the UK internal market, alongside robust commitments to protect the EU single market.

A flexible choice for businesses and consumers

We propose:

- goods can be placed on the market in NI if they meet either UK rules, EU rules, or both – ensuring that consumers can access the products they want, and avoiding gaps on supermarket shelves

- goods marked for the EU need to meet all relevant EU standards – in the same way that they currently need to

- goods could be marked with either a CE or UKCA marking or both if they meet the relevant rules

- approval could be granted by UK or EU bodies respectively

- this approach has been tried and tested in Great Britain – operating since January 2021 given the unfettered access we have guaranteed for NI goods

Unfettered access for NI goods in all scenarios

Whichever choice NI businesses make, they would be able to access the GB market with no barriers.

Bespoke approaches where required

We have been clear we would also work with industry to identify required modifications for specific sectors – ensuring at all times that we can address supply barriers.

Robust protections for the EU market

There would be a robust set of safeguards to avoid UK goods moving onto the EU market.

- importers, manufacturers and producers will remain liable for placing goods on the market in accordance with the correct rule – goods being placed on the market in Ireland would need to meet EU rules, just as they do now. Stringent penalties will apply for traders found to have broken these rules

- agrifood goods could move from Great Britain into NI only in line with our Trusted Trader Scheme – with robust penalties applied for violations. The EU has already accepted that it is possible to demonstrate that goods can enter and remain in NI under the existing scheme for goods sold in supermarkets

- market surveillance authorities will continue to have powers to enforce product safety within the UK internal market – to enter premises, seize goods and pursue legal action for criminal offences all of which would continue to be risk-based and intelligence-led. These efforts would be intensified, alongside cooperation between authorities in the UK, the Republic of Ireland and the EU to support compliance activity and parallel operations

3. Tax and spend

What is the problem

The Protocol stops Northern Ireland businesses and people from enjoying the same freedoms as counterparts elsewhere in the UK – despite there being minimal risk to the EU single market.

Though the UK-EU Trade and Cooperation Agreement agreed clear principles for open and fair competition on a zero-tariff and zero quota basis, EU state aid rules still apply in relation to trade between NI and the EU- limiting the level of support that may be granted in NI (or limit who is eligible, as with the COVID-19 Recovery Loan Scheme) without approval from the EU, creating significant uncertainty and a two-tiered system in the UK.

- this is despite the UK’s track record as a low-subsidy area – often significantly lower than comparable Member States. The EU’s own 2020 scorecard shows the UK gave fewer non-agricultural subsidies as a percentage of GDP than 17 of 27 EU Member States – yet this low risk profile is not reflected in arrangements under the Protocol

- Northern Ireland is part of the UK’s VAT and excise territory. However, as EU rules still apply on goods, people and businesses in NI are not guaranteed to benefit from UK VAT and excise reforms or reductions

- this has prevented access to recently announced reliefs on energy-saving materials – costing families in NI up to £300 in VAT relief on a typical solar panel installation – and new alcohol duty structures

- this is despite the UK operating its tax system fully in line with OECD best practice, and working with EU partners to continue work to raise standards (such as on global minimum tax rates)

Why we need change

The Protocol restricts the UK from providing the same tax and spend policies in NI as the rest of the UK – with little room for flexibility.

The Protocol applies EU state aid rules regardless of developments since – despite the robust subsidy control commitments agreed by the UK and EU in the Trade and Cooperation Agreement, which we have built on in the Subsidy Control Act 2022, the Protocol applies EU state aid rules with no means to adapt to the new context or the real risk posed – with aid schemes in the UK heavily constrained by EU regulations and processes

The Protocol does not allow for VAT and excise rules to be adapted for the unique context in Northern Ireland – EU rules limit the UK government’s ability to responsively set VAT and excise rates and reliefs in Northern Ireland, even if the changes would have no impact on the EU.

UK solution

New freedoms that allow the Government to provide support to companies and citizens across the UK – without any risks to the EU market.

Managing subsidy control on a whole UK basis

Relying on the binding commitments made by both sides in the UK-EU Trade and Cooperation Agreement – using the Subsidy Control Act 2022 to manage subsidies in the UK.

Freedoms to set VAT and excise rates, reliefs and structures for the whole UK

We would maintain the existing arrangements in the Protocol on VAT and excise to support trade on the island of Ireland. But we would provide freedom for Ministers to adapt or disapply rules so that people in NI can benefit from the same policies as those elsewhere in the UK.

Bespoke mechanisms for dialogue

Alongside existing structures for disputes and remedies in the Trade and Cooperation Agreement, the Withdrawal Agreement structures would also be used to provide rapid consultation and cooperation.

4. Governance

What is the problem

A democratic deficit as rules are made and imposed on Northern Ireland without ongoing democratic consent, and disputes are settled by EU institutions rather than normal international processes.

Unlike ordinary international treaties, disputes under the Protocol can be taken to, and settled by, the Court of Justice of the European Union – a court of one of the parties.

- while disputes are settled by arbitration in both the UK-EU Trade and Cooperation Agreement, and the rest of the Withdrawal Agreement, the EU insists on European courts as the final arbiter for the Protocol

Rules applying under the Protocol also take effect automatically once passed by EU bodies – with no say for NI representatives and no means to adapt them for the NI context.

- already, we have been informed by the EU of over 4,000 adopted measures within the scope of the Protocol since January 2021

- in some cases these have uniquely disadvantaged Northern Ireland – as when EU legislation unilaterally withdrew Northern Ireland’s access to Tariff Rate Quotas, restricting NI imports including steel and New Zealand lamb – and yet have not been subject to any dialogue beforehand

This state of affairs has – and continues to – undermine political stability, with a fundamental sense of unfairness and feeling of separation from the rest of the UK in Northern Ireland.

Why we need change

The Protocol bakes in those inequalities with no means of redress.

There are no structures for UK or NI representatives to have a say in EU rules – rules are simply automatically applied in most cases.

There is no barrier to limit access to unequal dispute structures – not only is this contrary to ordinary international norms, there are no mechanisms to preclude the CJEU being the first port of call for the EU when issues arise.

UK solution

Fair and balanced governance arrangements to resolve disputes and new freedoms for businesses and consumers in Northern Ireland.

Ordinary international dispute settlement – with more balanced arrangements that look to manage issues through dialogue, and then through independent arbitration.

New flexibilities and freedoms – our proposals, such as on dual regulation and the green channel, will give businesses and consumers new freedoms and choices which ensure they are not bound to follow rules over which they have had no say.